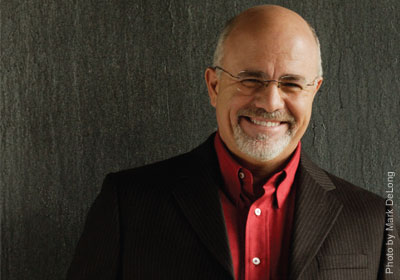

See that guy above? That’s Dave Ramsey. He’s the new man in my life. Or I should say OUR lives. Naaman and I took a leap of faith and enrolled in Financial Peace University.

We finally have a plan to get our finances in order. I am tired of being stressed about money and bills and the future. I am tired of worrying about what is in store for my boys’ futures. I am tired of working so hard and not being able to pursue our dreams. We want to control our money. Not having money controls us.

We signed up for the online classes in September. I have my friend Leah to thank for this. It has already taken a huge weight off of our shoulders.

To date we have paid off $5,000 in credit card debt in three months! We are on track to have it all paid off by the end of this year!

This process is scary. Correction – this process is TERRIFYING. In 2009, I resigned from my job two days before I found out I was pregnant with my second child. We went from debt-free to super stressed in about four weeks. I don’t think we are in that much trouble, but we knew if we continued to spend like we were, then it would come crashing down just like the rest of the economy.

Before each month begins, we have a budget meeting and set our budget for the coming month. There has to be a category for everything. Anything that is leftover goes to your debt. No more confusion at the end of the month when we see how much income we brought in and have no idea where it went. This isn’t a game of Monopoly or Settlers of Catan. It doesn’t grow on trees (no, really, I checked just to be sure).

Have you ever gone to your fave store and tried to buy only the things on your list? No stopping at the jewelry counter. No gawking at the cute winter clothes. Not even designer shampoo will work as an example of items that might squeak by in the “but I needed it” category.

Case in point – I recently needed to run to Target to buy two items. This was after we started Dave’s program. I decided not to get a cart because, hello, it would have looked lonely without something else in it. So I walked in and got only what I needed. I was literally shaking in the check out line because I wanted to buy something. I didn’t care what it was. It could have been watermelon bubble gum. I just wanted. Wanted. Wanted. Wanted.

That’s what we call an addiction, folks. I’ve been hesitant to call my shopping habits an addiction because I never shop at expensive stores anymore. But buying a lot of inexpensive stuff eventually adds up. I call it the detox phase of debt reduction. It got much easier after the first month.

The frivolous spending had to stop if we wanted to be debt-free. I mean just that. No credit cards, no car payments, no student loans and eventually (gulp) no mortgage. And before you say no way – just know it can and will be done. I just have to stop buying a new wardrobe every time I walk into Target and stop going out for lunch every day.

The thing I love best about FPU is that Naaman and I are working as a team. We are both taking the classes. We are talking about money in a healthy way. We are learning and growing together as a couple. We are not going to let debt pull us under.

- So we’re cutting the credit cards up (sob and also? Scary).

- We’ll be using the envelope cash system. When the money is gone it’s gone.

- We’re meal planning with e-mealz again and setting a strict budget on groceries. Our food expenses were way out of control. Not anymore. We shop primarily at Aldi. I don’t care what anyone thinks. It’s awesome. My weekly grocery bill is always under $100 for all meals for four people. Sometimes I do even better than that! And I save time because there aren’t 50 choices of pasta sauce.

- No vacations. Maybe not for a long time (big tears but Dave says the best vacations are the ones that don’t come home with you!).

- No new home décor or furniture. This is so difficult since we just moved. But I can thrift!

- I unsubscribed from store emails. It doesn’t make sense to save money on shit I don’t need anyway. Cutting out the temptation.

- We’re being strategic with gift-buying (including Christmas) and starting a budget for that category.

- We take our lunches to work now, usually leftovers from our yummy meal the night before.

- I’m not going into a store unless it’s a necessity (until I feel strong enough to do so without busting the budget). Thanks to Allison, I just discovered the awesomeness that is The Dollar Store.

- We will learn to say no to our kids. Oh guys, if I could explain to you how difficult this is for me. I want to them to have everything they want and my heart still breaks a little every time I say no. But apparently saying yes all the time is not healthy for them either.

I know this sounds extreme. I know managing your finances is usually a private topic and it’s a personal choice as to how you handle it. I’m sure there are plenty of people who have a good system and use credit cards responsibly. But I thought I might help someone by putting this out here.

And just so you can see that I’m being honest? Here’s a photo of our murdered credit cards. I may have cried when I cut up the Banana Republic Luxe card. But now I’m so glad I did.

p.s. I was not paid or compensated in any way to write this post. Dave Ramsey has no clue who I am although I wish he did. I’m just hopeful and you know, sharing is caring in the blog world.

Leave a Reply